As Network, we’re equipped to offer our merchants who use our Payfast ecommerce solution with the best tech to accept seamless online payments. Other than an array of popular payment methods and plugin integrations, we also offer features like tokenization as a standard feature to make it easier and safer to receive recurring credit card payments.

Below we delve into what payment tokenization is and how it benefits our merchants and their customers. We also introduce and explain Scheme Tokenization, and what it means for you as a merchant.

What is payment tokenization?

Payment tokenization is a powerful technique used to secure sensitive payment data during transactions. Instead of transmitting actual credit card numbers or other confidential information, a unique token is generated and used in place of the original data. By using tokens, payment platforms can minimise the risk of data breaches and fraudulent activities. This is because even in the highly unlikely scenario that tokens are intercepted or stolen, they are useless to fraudsters as they lack any meaningful information.

How does payment tokenization work?

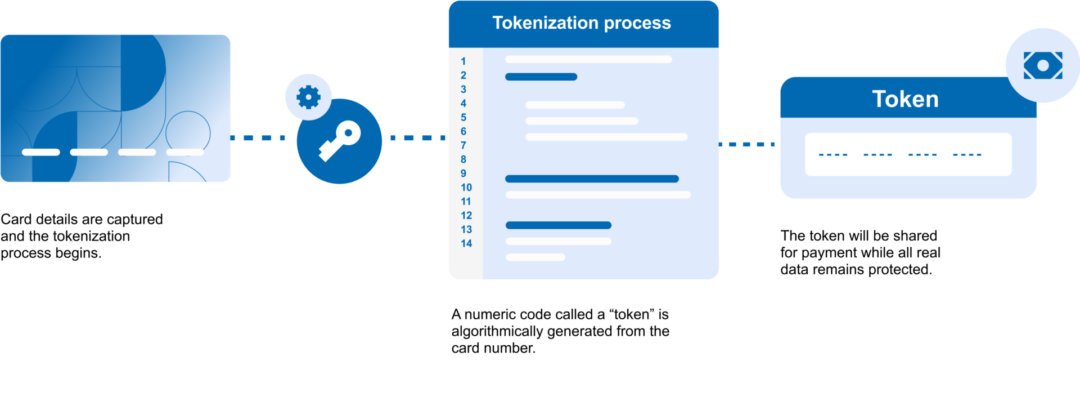

Tokenization is used by payment processors to enhance security for their merchant partners and their customers. The process of how tokenization works is depicted in the infographic below.

When an online shopper initiates a payment through a payment platform their credit card details are tokenized. The tokenized data is then transmitted securely throughout the entire payment process, ensuring that sensitive information remains protected.

Unlike traditional credit card payments, where the primary account number (PAN) is transmitted during transactions, tokens replace the PAN with a unique token. It’s this process that reduces the risk of exposing sensitive card data during online payments.

What are the merchant benefits of tokenization?

For online stores and other businesses that accept online payments, tokenization has the following benefits:

- PCI compliance: Tokenization helps merchants maintain Payment Card Industry Data Security Standard (PCI DSS) compliance. By using Network’s Payfast ecommerce solution, we make sure you don’t have to worry about PCI compliance as we are compliant ourselves.

- Reduced liability: With tokenization, merchants are less exposed to liability in case of data breaches.

- Streamlined checkout: Tokenized payments lead to faster and more efficient checkout experiences.

What are the consumer benefits of tokenization?

For consumers who shop and pay online, tokenization has the following benefits:

- Enhanced security: Consumers can trust that their payment information is safeguarded.

- Automatic card updates: Tokenization supports automatic card updates, reducing declined transactions due to outdated card details.

- Increased approval rates: Issuers view tokenized payments as more secure, potentially leading to higher approval rates.

What is Scheme Tokenization?

Scheme Tokenization, also known as Network Tokenization, is a newer version of payment tokenization that’s centrally managed by the card scheme, ie Mastercard and Visa, instead of us, the payment platform. This centralised management allows for efficient updates, reissuance and revocation of tokens when needed. As such, Scheme Tokenization is more compliant and one may even say safer, as risk sits solely with the card networks and not with us, the payment platform, or you, the merchant. As the card scheme processes the tokenization of the card details, the card details are never saved on our records and not processed by the banks.

We’re in the process of automatically activating Scheme Tokenization for all our merchants to replace the normal tokenization feature. This updated feature is being implemented through an integration with the schemes and the acquirers, which takes place on our back end and doesn’t require merchants to update their APIs.

If you haven’t already partnered with us to receive payments online, sign up now to benefit from Scheme Tokenization, or contact our Sales Team for any questions.