Getting started with a POS machine

Sleek, easy to use and ideal for a wide range of businesses, Point-of-Sale (POS) machines streamline sales and payments. These devices provide a hassle-free in-person payment solution for restaurants, retailers, service providers and many other businesses. Customers have the benefit of a cashless payment option, while businesses benefit from fast and secure transactions. If you need a streamlined way to get payments, a card machine is the best solution to help your business grow.

How do POS machines work?

POS technology provides a cashless solution for in-person transactions. They are simple to set up, and even simpler to use. To make it easy to keep track of inventory, product ranges can be easily uploaded and managed on the device. A merchant dashboard allows sales reports and other data to be easily tracked, providing insight into sales trends.

For customers paying by card, these devices accept cards from providers like Mastercard, Visa and Diners Club with a quick tap or insertion. Customers can also make payments using mobile wallets such as Apple Pay, Samsung Pay and G Pay, allowing them to pay with their preferred payment method.

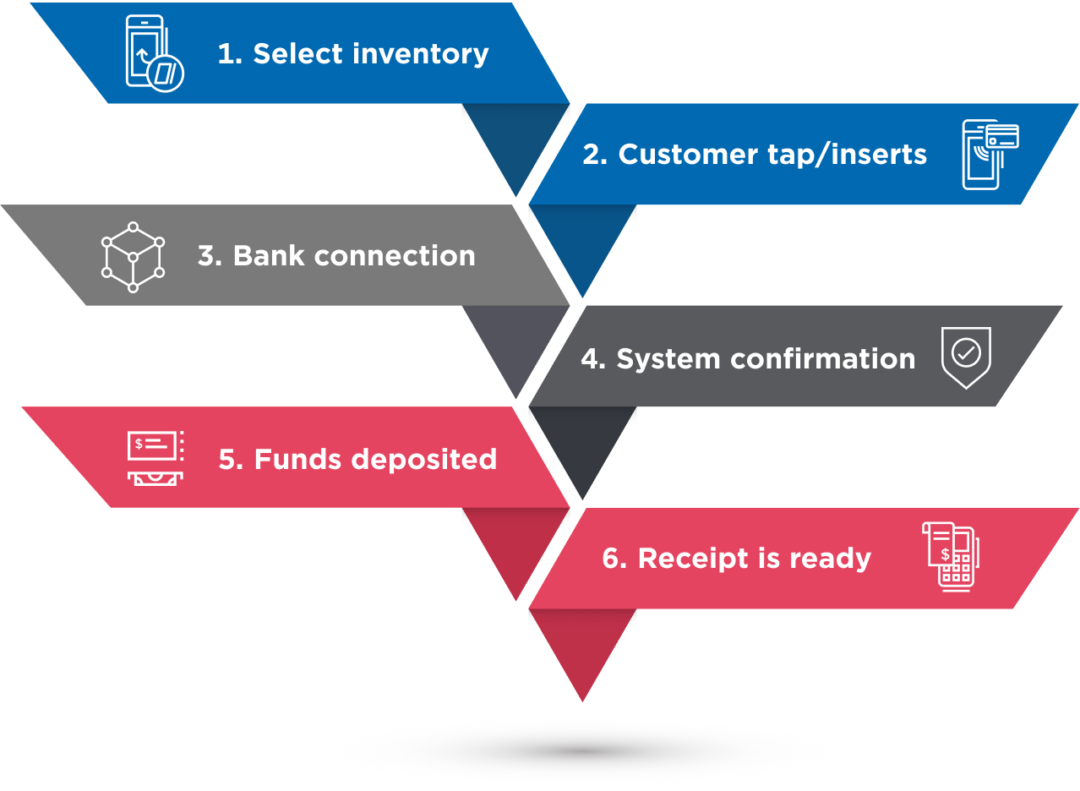

This is how a POS machine works:

- The merchant selects the inventory item on the device that the customer wants to buy to display the total amount due.

- The customer inserts or taps their card, smartphone or smartwatch that’s preloaded with their mobile wallet. If required, they are prompted to enter their PIN.

- The device connects to the customer’s bank.

- The bank checks if funds are available to clear the transaction.

- The system confirms whether the payment has been approved or rejected.

- Once the payment is completed, the funds are deposited into the merchant’s account linked to the POS device, for example, their Payfast by Network account.

- Upon completion, the receipt can be printed or sent to the customer via SMS or email.

How do you use a card machine?

As a business, getting started with a POS device comes down to loading products, connecting to WiFi or using the built-in SIM card and letting the system do the rest. As card machines are designed to accept payments anywhere, they can be used instore, at markets, outdoor events and on the go. They can also be used by service providers working outside of the office or smaller stores.

Because POS devices are easy to set up and use, the learning curve is minimal. This means that employees don’t require much training to get started.

What are the advantages of POS machines?

From convenience to an enhanced customer experience, there are many advantages of POS machines. Some of the biggest benefits include the following:

- Reduced barrier to completing sales. Faster payments mean more chance of making that sale, which in turn ensures business success.

- Enhanced customer experience. Systems enabling multiple payment methods make it easier for customers, whether paying by card or mobile wallet, to complete their purchases using their preferred payment method.

- Secure payments. Secure transactions are a win for businesses and customers, ensuring peace of mind at all times.

- Convenience and ease of use. Once transactions are complete, payments are deposited straight into your POS account. If you use Payfast by Network, you can request an immediate payout into your linked bank account for quick access to your funds.

- Insights into sales trends. Through the POS dashboard, access insights and analytics to easily track sales trends and product data.

Where do you get a POS device?

You can easily sign up with Payfast by Network online and order our comprehensive Network POS device to streamline your in-person payment process. From busy coffee shops to pop-up shops, non-profits taking donations at fundraising events or service providers that are always on the go, we make it easier to get paid. Benefits such as competitive transaction fees plus additional ways to boost revenue through airtime, data and voucher sales provide even more value. The Network POS device starts from R999 once off, with a small monthly connectivity fee.

For peace of mind, our system is fully secure, backed by Network’s robust technology and compliant with PCI-DSS requirements. Every transaction is screened for suspicious activity, minimising the risk of chargebacks. This allows you to build a solid reputation as a business and allows your customers to pay knowing that their transactions are secure.

To find out more about our Network POS device, get in touch with our Sales team now.