Understanding payments for small businesses

Payments can feel overwhelming, especially when there may be other aspects of running a business demanding your attention. At its core your business needs a way to get money from customers safely and quickly. That’s where a payment platform, payment provider, or online payment system comes in.

- Payment platform: The hub where transactions happen. Think of it as your payment control centre.

- Payment provider: The company giving you the tools to accept payments.

- Payment gateway / payment system: The secure bridge moving money from your customer to your account.

Things to consider:

- “Do most of your sales happen online, in-store, or both?”

- “Which payment methods do your customers prefer?”

Small business owners like you usually want to know: does the payment platform work reliably, how quickly will the money land and are the payment options flexible enough for everyone buying from you?

Think of it like the shop floor. Each system has a job and when they work together, your money gets where it needs to go.

Getting paid faster can make the difference between restocking today or waiting until next week.

The role of online payment systems in South Africa

South African shoppers are used to moving fast. They want secure payments that suit their lifestyle – whether that’s cards, QR codes, Instant EFT, or mobile wallets. Digital payments and in-person methods are growing in popularity , supporting financial inclusion for small businesses. But local quirks can trip up sales: EFT delays, bank cut-offs or unfamiliar payment platforms can slow transactions and frustrate customers. A reliable online payment system for small businesses helps you avoid these hiccups and keeps your operations running smoothly.

How it helps your business locally:

- Supports funding applications: Lenders and investors in South Africa often review consistent sales and cash flow records when considering loans or overdrafts.

- Supports day-to-day operations: Handles online and in-store payments quietly so you can focus on customers instead of chasing money.

- Protects cash flow: Fast, dependable payments improve financial stability and make it easier to plan for stock, payroll, or expansion.

- Keeps transactions flowing: Avoids delays caused by local banking schedules or payment failures.

How payments affect small business funding in South Africa

Smooth, consistent payments don’t just make day-to-day life easier – they also impact small business funding in South Africa. Banks and providers check for consistent cash flow and regular sales before approving loans, overdrafts, or investments. Slow or failed payments can make getting the support you needed harder.

Try asking yourself:

- “Is your current system showing a clear record of sales for potential funders?”

- “Could faster payouts help you grab stock before a busy weekend?”

Digital payments and alternative methods are growing fast in fintech South Africa, giving small businesses more efficient ways to get paid. Using a solid online payment system keeps payments running smoothly, making cash flow steadier and giving your business a better chance to secure funding when needed.

A payment system designed for South Africa keeps money flowing, operations smooth and customers coming back.

Comparing payment platforms

Choosing a payment platform for a small business isn’t about the flashiest tech. It’s about fit. Some platforms focus on e-commerce only, while others are built for in-person payments too. A few charge high monthly fees, which can sting if you’re just starting out. Others take a small cut per transaction but don’t tie you down with contracts.

In South Africa, there are plenty of players offering different setups. At the end of the day, it’s about what makes life easier for you and the people buying from you.

Things to think about when comparing payment system options:

- Costs: Do you want predictable monthly fees, or pay-as-you-go?

- Speed: How quickly do you get your money after a sale?

- Features: Do you need online checkouts, QR payments, recurring billing, or card machines – or just one of these?

- Support: When something goes wrong (because it will, at some point), is there a real person you can phone or chat to?

The right payment system really depends on where you’re at. If you’re just starting out, hunting for the best payment gateway for startups can save you time and unnecessary fees. For more established shops, the best online payment gateway for small business strikes the balance between features, reliability and ease of use. Whatever your size, the goal is a payment solution that works, letting customers pay without any drama.

The right payment platform doesn’t get in your way. It lets the sale happen, then quietly does the rest.

Benefits of using Payfast by Network

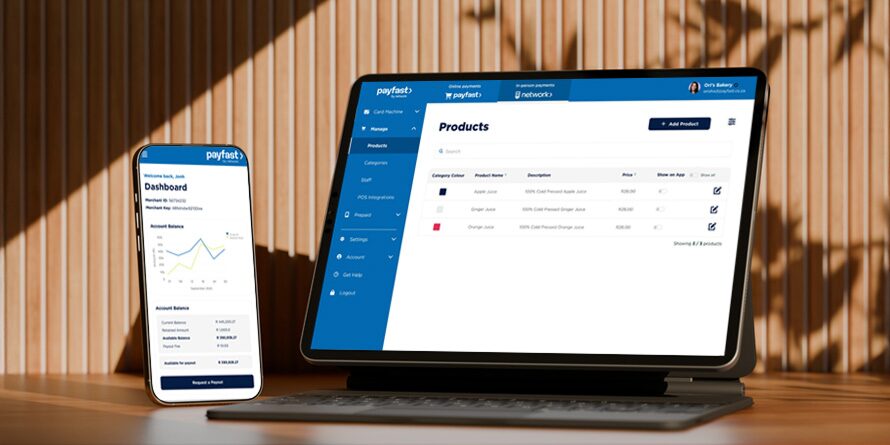

Running a small business means you don’t have time to fiddle with complicated systems. Payfast by Network was built with that in mind, combining online and in-person payments in one place. It’s simple, quick to set up and it works where your customers are.

Here’s what makes Payfast by Network stand out for South African businesses:

- Fast access to funds: You don’t want to wait days to see your money. With Payfast by Network, payouts land in your account almost immediately with immediate payouts.

- Merchant solutions: From buying airtime to topping up data or buying electricity, our POS device lets you offer services that bring people back to your till. Other value adds for our merchants include business funding, an intuitive dashboard and our Payfast App.

- Safe and compliant: Fraud and chargebacks can knock a small business hard. We’re PCI DSS Level 1 certified with proper encryption – that’s the global gold standard for payment security. Every tap, swipe or scan is protected.

- Card machines + online checkout in one place: Accept multiple payment methods both online and in-person. Instead of juggling two different providers, you can do it all with one system.

Instead of acting like another faceless “tech provider,” Payfast by Network keeps things practical: get paid quickly, keep customers happy and run your business without stress.

The right payment system should feel like part of your team, not another admin headache.

Security and Compliance

When money moves, trust matters. If a customer doesn’t feel safe making a payment, they’ll walk away. It’s as simple as that.

Payfast by Network handles compliance and security for you:

- PCI DSS Level 1 certified

- End-to-end encryption for card and digital payments

- Less admin around chargebacks and disputes

Instead of trying to handle security on your own – which no small business owner has time for – you’ve got a partner that bakes compliance in from the start.

Safe payments aren’t a luxury, they’re the foundation of customer trust.

Getting started with Payfast by Network

Signing up doesn’t need to be a mission. With Payfast by Network, you can get going online in just a few steps:

- Create your account — sign up online, no paperwork drama.

- Activate and start trading — once approved, you’re ready to accept payments.

- Submit your documents — quick digital upload, no queues.

Features for day-to-day management:

- Payfast Always Open for 24/7 payment access.

- Business portal to manage transactions.

- Payfast app for mobile control.

- Card machine support for in-person sales.

You don’t need to be a tech whizz to set it up. The process is built for busy business owners who’d rather focus on sales than forms.

And if you get stuck, the support team is just a call or live chat away. No need to figure things out solo.

Sign up today, trade tomorrow.

Shoppers in SA expect things to be quick and simple. They want to pay securely, with whatever works best for them. A solid online payment system or card machine handles this quietly, keeps checkout moving and encourages customers to return.

These payments also keep your cash flow moving. Business moves fast, so you need a system that can keep up. By handling money behind the scenes, a reliable payment system frees you from admin stress. How you get paid affects everything from restocking to daily operations. The right payment options and smooth payments for your small business make running your operation simpler and more manageable.