When you start doing research into launching an ecommerce store, one important term that will definitely appear on your radar is payment gateway. While often overlooked by merchants setting up their first online store, it’s an extremely important component that enables online shoppers to pay you on your website. So without a payment gateway, your online store would literally just be a catalogue of products lacking the ability to receive payments. Which isn’t particularly useful to your business or your customers.

What is a payment gateway?

At its core, a payment gateway is the technology that enables merchants to accept payments from their customers. This is accomplished by acting as the link between your website and the payment provider or customer through which the secure payment data flows through. This includes point-of-sale terminals such as card machines and QR codes that can be scanned via smartphone apps like Zapper and SnapScan in physical brick-and-mortar stores, as well as payment processing portals that receive and process payments made online, such as on ecommerce marketplaces and online stores.

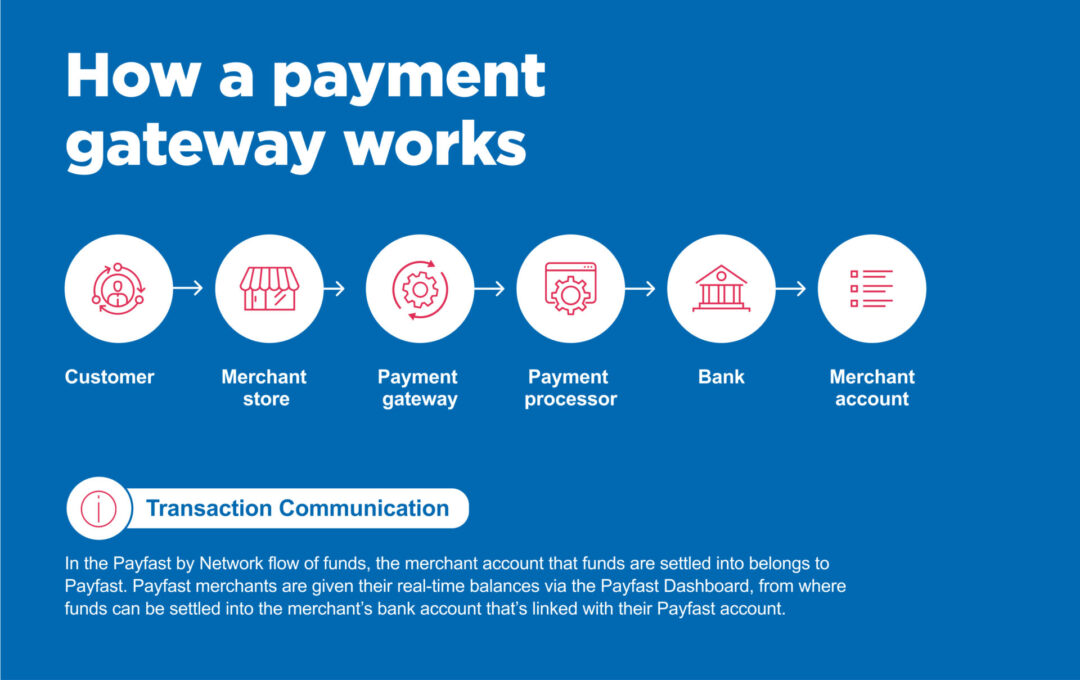

The infographic below demonstrates the role of a traditional payment gateway in an ecommerce scenario.

Around the world there are a few recognisable payment service providers that act as a payment gateway for their merchants. In South Africa, Payfast is a popular online payment solution that processes payments on behalf of more than 80,000 merchants.

How does a payment gateway work?

Although the term payment gateway specifically refers to the technology that sends the payment data to the merchant acquiring bank, it’s generally used as an overarching term that includes payment solution, payment platform, payment aggregator and payment facilitator.

The payment gateway process

The process of how a payment gateway works, specifically a payment aggregator as in the case of Payfast, can be simplified to the following steps:

- An online shopper adds an item to their shopping cart on your website.

- When they are ready to complete the purchase, they go to the checkout page where they add all their delivery details and select to make a payment.

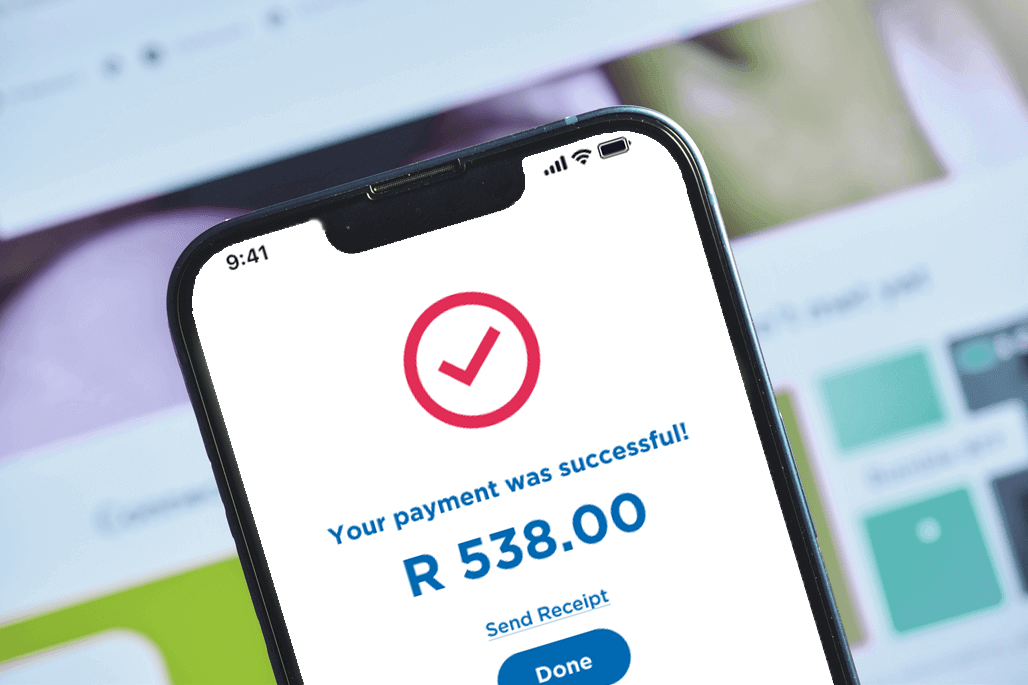

- Customers are redirected to the secure Payfast payment engine where they can select their preferred payment method and follow the steps. Payfast processes the payment and notifies your ecommerce platform once the payment has been completed successfully so you can deliver the product to your customer.

- The payment is deposited into your Payfast account, from where you can request a payout into the bank account that’s linked to your Payfast account.

Why do you need a payment gateway?

You need a payment gateway to receive payments online via your ecommerce store. While different payment gateways offer different services, generally they should all give you peace of mind that your customer’s payments are being processed safely and securely.

What are the benefits of a payment gateway?

A payment gateway can also enable you to get paid via a variety of payment methods, not just credit cards. For example, Payfast facilitates Mastercard and Visa credit card and debit card payments, Scan to Pay, SnapScan, Zapper, Instant EFT, SCode and Mobicred. A good payment gateway should also provide consistent fraud protection by being PCI Compliant, as well as providing services to manage credit card chargebacks, reconciliation and overall account management.

Enhanced security

One of the primary advantages of a payment gateway is the heightened security it offers. With advanced encryption and fraud detection measures, payment gateways provide a secure environment for online transactions. This instills confidence in customers, as sensitive financial information is protected, reducing the risk of fraudulent activities and unauthorised access.

Convenience

Payment gateways offer customers a wide range of payment options, including credit cards, debit cards and online wallets, providing unparalleled convenience and flexibility. Customers can choose their preferred payment method, making the purchasing process more seamless. Moreover, payment gateways facilitate quick and hassle-free transactions, eliminating the need for manual processes like cash handling or check clearance.

Global reach

For businesses, payment gateways open doors to global markets by enabling international transactions. With a payment gateway, companies can accept payments from customers around the world, expanding their customer base and boosting revenue streams. This global accessibility allows businesses to tap into new markets and foster growth opportunities.

Faster settlements

Traditional payment methods often involve lengthy processing times, resulting in delays in fund settlements. However, payment gateways expedite this process by enabling real-time or near-instantaneous settlements. This benefit is particularly advantageous for businesses that rely on quick cash flows, as they can access their funds faster, improving liquidity and cash management.

Analytics and reporting

Payment gateways provide businesses with valuable insights through detailed analytics and reporting features. Merchants can access comprehensive data on transaction volumes, customer behaviour and sales trends. This information helps in making informed business decisions, identifying potential areas for improvement and optimising marketing strategies.

Some of the benefits of choosing a payment gateway like Payfast is that you can sign up and start receiving payments without the need for a merchant bank account. You also don’t need to be concerned with meeting the rigours of PCI DSS requirements, which are necessary when handling sensitive credit card information, as Payfast handles this for you.

How do you choose a payment gateway?

When choosing a payment gateway it’s important to do your research to determine the following:

- Which payment gateways are available in your country?

- Are they PCI-DSS Level 1 Compliant?

- What are their fees, for example, do they have monthly fees and/or a per transaction fee and any hidden fees?

- What ecommerce platforms do they integrate with or have 3rd party plugins for?

- What additional services do they offer, and are these free or do they come at an additional cost?

- Do they offer local after-sale and customer support?

- Do they have good reviews online by merchants and customers?

How do you set up a payment gateway?

There are several ways websites can integrate into a payment gateway. Some require developers to be involved and are complex, while others work with pre-built shopping carts, that usually just require an ID and other basic information from the gateway, in order to be integrated.

Setting up your Payfast payment gateway

Setting up Payfast as your payment gateway is a simple process that can literally take minutes depending on your ecommerce platform. Payfast integrates with over 80 different shopping cart platforms, including Shopify, WooCommerce, Ecwid and PrestaShop as well as custom integration. Take a look at our shopping carts page to find your platform’s listing which will include information on how to set up the Payfast payment gateway on your online store. You can also read this ‘How to integrate PayFast and get paid’ blog for more information.

If you’re not sure which ecommerce platform is right for you, read our blog about Ecwid as well as this one which compares Shopify and WooCommerce.

When setting up your online store it’s important to sign up and get your payment gateway up and running quickly so that you can start receiving payments as soon as you’re open for business. With the right business model and payment gateway, there’s no stopping what your online store can accomplish.