Whether you’re an innovative startup or an established enterprise, we’re ready to help you navigate the exciting frontier of digital payments. Irrespective of where you’ve come from or where your business is going, we understand the importance of offering a secure and seamless payment experience to your customers. That was one of the main reasons why in 2023, under Network International, Payfast and Paygate united under the reimagined Payfast brand to offer you an array of world-class features and solutions to take your business to the next level.

With Payfast acting as a payment aggregator and our Paygate solution as a payment gateway, together we’ve got all your digital payment needs covered. One question you may ask, however, is which solution is right for your business?

While both payment gateways and payment aggregators facilitate electronic transactions, they differ in their functionality, structure and the services they offer. Below we provide an overview of the two payment processing solutions to help you make an informed decision of which one is right for your business when signing up with us.

What is a payment aggregator?

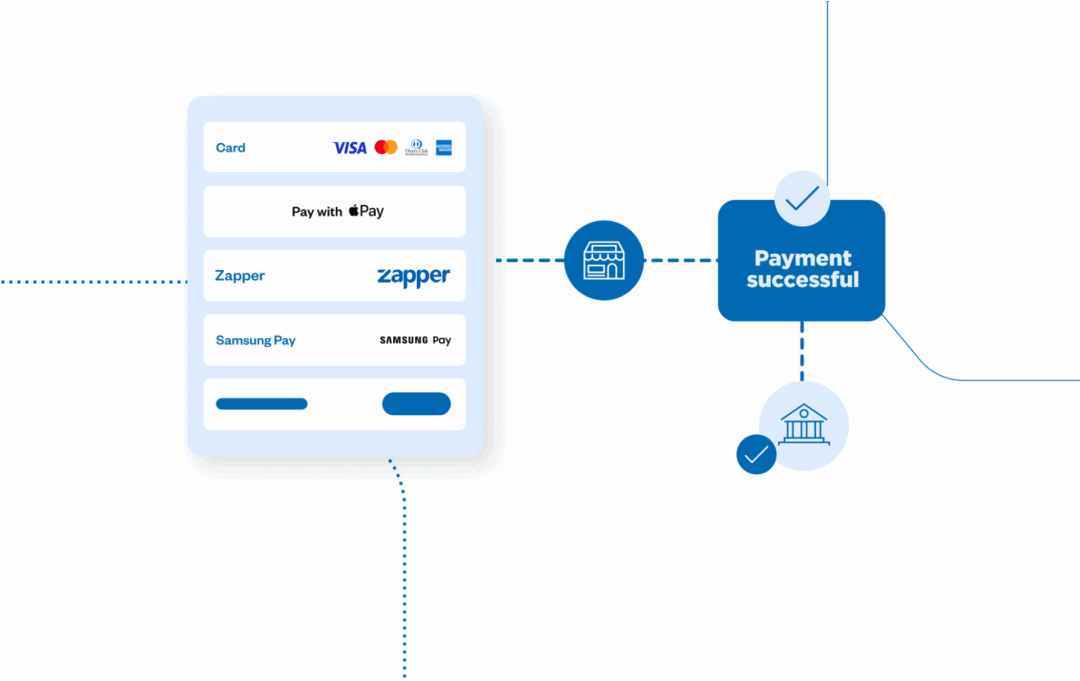

Payment aggregators simplify the online payment process for merchants by providing a single integration point to accept payments online. Through one integration, businesses can offer a variety of payment methods that cater to diverse customer preferences.

This plug-and-play solution is ideal for small to medium sized businesses and startups that don’t have a merchant account with a bank, which is difficult to get without proof of your business’ longevity. Payment aggregators have their own merchant bank account, allowing them to streamline the payment process by aggregating multiple merchants under a single merchant account.

As a result, it’s far easier and quicker for merchants to sign up with an aggregator and start getting paid online. It’s quick and easy to set up and bypasses the complexity of managing their own merchant account.

What is a payment gateway?

Payment gateway solutions act as the virtual bridge between the merchant’s website and the payment processor. They securely transmit transaction data from the customer to the payment processor and back, ensuring sensitive information is protected.

Instead of offering one integration with a variety of payment methods like an aggregator, payment gateways operate on a one-to-one relationship, connecting a specific merchant to a specific payment processor.

Unlike payment aggregators, businesses are required to have their own merchant bank account, making this solution more appropriate for large enterprises and businesses, such as those in the tourism, hospitality, property management and gaming industries that have high transaction volumes.

Overall, payment gateways tend to provide merchants with greater customisation options, allowing them to control the checkout process, user experience and branding, which is ideal for larger enterprises with specific branding and user experience requirements.

What are the main differences between Aggregation and Gateway?

There are a few key differences between our payment aggregator and payment gateway solutions. Other than the requirement of having your own merchant bank account to use our gateway solution, we’ve outlined some of the main things in the table below:

| Payfast Aggregation | Payfast Gateway | |

| Offered payment methods | Cards (Visa and Mastercard) Instant EFT SnapScan Zapper Scan to Pay Apple Pay Samsung Pay Capitec Pay Mobicred Mukuru Pay SCode RCS Store Cards MoreTyme | Cards (Visa, Mastercard Amercian Express, Diners Club and Union Pay) SiD Secure EFT Capitec Pay PayPal MTN MoMoPay Visa Checkout Mobicred SnapScan Zapper Scan to Pay Samsung Pay |

| Integrations | A single integration that offers a variety of payment methods. There are over 70 plugins available for leading shopping carts and ecommerce platforms, as well as custom integration. | A one-to-one integration with each payment method though Payhost, our gateway enterprise API, as well as a variety of other plugins. |

| Additional free-to-use features | Subscriptions – set up recurring billing Tokenization – accept recurring card payments Split Payments – instantly split a portion of a payment with a third party Payment Request – accept payments via email Pay Now buttons – easily create buttons that can be embedded on your website or invoice Easy Advance – business funding in partnership with Retail Capital | Paybatch – capture and process batch transactions Payvault – accept recurring card payments Paybill – secure email invoicing Payprotector – fraud management in a real-time environment Paysubs – subscription payments Paypoint – a virtual secure point of sale card machine |

| Fees | No monthly or hidden fees, you only pay per successful transaction. Find out more here. | Month-to-month contract which you can cancel at any time. Find out more here. |

Choosing the right payment solution for your business

Choosing between a payment gateway and a payment aggregator depends on the specific needs and characteristics of your business. Larger enterprises may prefer the customisation and control offered by payment gateways, while startups and small businesses may find the simplicity and accessibility of payment aggregators more appealing.

If you have any other questions about which Payfast solution is right for you and how we can help your business succeed in the digital economy, please don’t hesitate to reach out to our Sales Team.